Are you unsure if BBA is a suitable substitute for CA? Find out why, after 12th grade, commerce students may find that a BBA in Accounting, Taxation, and Auditing is a better option. If you have a history in business, it’s likely that someone has already inquired about your preparation for the CA.

Following Class 12, commerce students frequently have to make one of the most important decisions of their academic careers: selecting the appropriate professional route. Many people have historically chosen chartered accounting (CA) because of its reputation and the promise of financial stability. The Bachelor of Business Administration (BBA), particularly with specializations like accounting, taxation, and auditing, has begun to attract more interest in recent years.

Even while becoming a Chartered Accountant is still a respectable career path, there are other ways to succeed in the business world. This blog will discuss the reasons why BBA is becoming a wise and useful substitute for CA, particularly for those seeking a well-rounded academic experience and a variety of job options.

Click Here for BBA in Accountancy, Taxation & Auditing Course Overview

Confused Between CA and BBA? Here’s What You Need to Know

Since both the CA and the BBA have a business foundation, yet lead to very distinct career paths, it is normal for people to be confused about them.

- The Institute of Chartered Accountants of India (ICAI) oversees the professional certification program known as CA. It requires years of focused study, is demanding, and has a high dropout rate.

- In contrast, the three-year undergraduate BBA program provides a thorough understanding of management, finance, and business. It provides access to a variety of industries, is more regimented, and frequently involves internships.

- Your personal ability, hobbies, and professional aspirations will determine which option is best for you. Let’s take a closer look.

What Is CA and Why Is It Popular Among Commerce Students?

Chartered Accountancy is a professional program that emphasizes accounting, auditing, taxation, and financial reporting. A career in CA is frequently seen as prestigious because of the following reasons:

- Potential for high earnings

- Good job stability

- The chance to work for prestigious companies

- In the financial sector, respect and acknowledgment

Nonetheless, it’s critical to recognize the difficulties associated with the CA course which are:

- The pass rate is infamously low; at final levels, it frequently falls below 10%.

- It requires a great deal of dedication, frequently at the expense of social and personal time; many students take five to seven years or longer to finish the course.

CA is not for everyone, despite its appeal. BBA is a good and increasingly well-liked substitute in this situation.

Want a career in finance without the exam marathon? Explore BBA options at Inspiria

Why BBA in Accountancy, Taxation & Auditing Is a Smart Alternative to CA?

Many of the fundamental skills that a certified public accountant would master are offered by a specialized BBA in Accountancy, Taxation & Auditing, but in a more comprehensive and accessible style. Here’s why it’s a wise decision:

- Balanced Curriculum:- In addition to business management, human resources, marketing, and communication skills, the BBA curriculum incorporates accounting principles, financial management, tax regulations, and auditing standards. Students receive a well-rounded education as a result.

- Greater Flexibility:-BBA programs enable internships, workshops, and real-world projects that educate students for the actual world, in contrast to CA programs, which are strict and exam-focused.

- Lower Dropout Rates:- CA has a high dropout rate because to challenges. Students can stay on course thanks to the progressive, structured, and encouraging nature of BBA programs.

- Pathway to Further Studies:- When students discover their talents, they can use a BBA as a basis for a later MBA, M.Com, CPA, CFA, or even CA, allowing them the freedom to select a specialization.

- Faster Entry Into the Job Market:- After graduating with a BBA, students can start their careers with professional skills, work experience, and sometimes industry credentials.

See Details on InSkills Soft Skill Training at Inspiria

Who Should Choose BBA Over CA?

Your learning preferences, career objectives, and learning style will all play a role in your decision between a CA and a BBA. Who could gain more from selecting BBA?

- Learners who favor organized instruction over independent study.

- Those seeking early financial independence and a quicker professional entry.

- Anybody seeking a balance between coursework, extracurricular activities, and internships;

- Students seeking a variety of career opportunities outside auditing and taxation.

- Those who desire a degree-based credential that allows them to pursue more education.

A BBA might be a more sensible and useful course of action if the thought of devoting more than five years to studying for unpredictable test results seems overwhelming. If you enjoy structured academics, diverse subjects, and hands-on learning, then BBA is a great BBA alternative to CA.

What Career Opportunities Does BBA Offer Compared to CA?

After graduation, BBA graduates have more employment opportunities than CAs, who typically work in auditing firms, financial departments, or as independent practitioners. A BBA instead of a CA opens you a variety of job options in the government, corporate, and finance sectors. Let’s make a comparison:

Career Options After CA

- Chartered Accountant

- Auditor

- Tax Consultant

- Financial Analyst

- CFO (with experience)

Career Options After BBA in Accountancy, Taxation & Auditing

- Tax Analyst

- Junior Accountant

- Audit Assistant

- Business Analyst

- Banking and Insurance Executive

- Finance Manager (with experience)

- Entrepreneur

- MBA or M.Com student for specialization

Moreover, BBA graduates can work in MNCs, startups, banks, consulting firms, government sectors, or even begin their own ventures. The versatility is unmatched.

Want a job after graduation? Apply to Inspiria’s BBA today for real placement support.

Why Inspiria Is the Best Place to Study BBA in Accountancy

Selecting the appropriate institution is essential when thinking about a BBA program. Siliguri, West Bengal’s Inspiria Knowledge Campus is a renowned university offering BBA programs in accounting, taxation, and auditing. This is the reason:

- Curriculum Aligned with Industry:- The curriculum offered by Inspiria was created in collaboration with professionals in the field. In addition to theory, students study real-world software tools, market trends, and practical applications.

- Highly Competent Teachers:- In order to give students the greatest possible academic and practical education, the faculty is made up of academicians, industry professionals, and chartered accountants.

- Learning Based on Skills:- Inspiria places a strong emphasis on experiential learning via case studies, real projects, and workshops. Students gain knowledge of Tally, Excel, GST software, and other technologies that are pertinent to the industry.

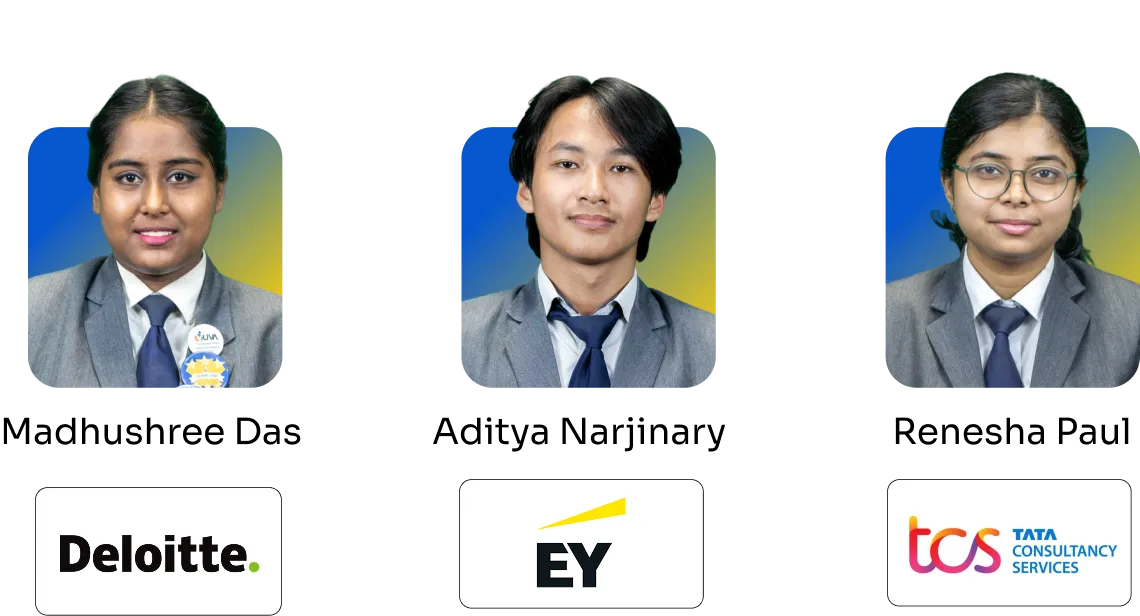

- Support for Internships and Placements:- Students are given the chance to intern with reputable companies and land positions after graduation thanks to the dedicated placement cell. Reputable finance companies and major multinational corporations use Inspiria alumni.

- Development of the Whole Person:-

Through leadership development and communication skills instruction, Inspiria makes sure students are prepared for great careers rather than just employment. - Contemporary Facilities:- With smart classrooms, digital labs, a company incubation center, and networking events, the campus provides a contemporary learning atmosphere.

Choosing Inspiria means choosing a future-ready education that prepares you not just for a job but for a lifelong career in finance and business.

Final Thoughts – CA Isn’t the Only Option for Commerce Students

Even while chartered accounting is still a highly esteemed and fulfilling career, there are other ways to succeed in the business world. Many students find that a BBA in Accounting, Taxation & Auditing is a more sensible, adaptable, and equally fulfilling option.

It enables students to explore different areas, start working sooner, and develop a career on their own terms. With the correct school, such as Inspiria Knowledge Campus, students can acquire the knowledge, abilities, and experience required to succeed in the fast-paced corporate world of today.

Therefore, don’t undervalue the potential of a specialized BBA program if you’re a commerce student unsure about whether to pursue a more dynamic road or the more conventional CA path. Business, finance, and entrepreneurship have a bright future ahead of them, and a BBA could be the ideal starting point.

Exploring a BBA alternative to CA is not giving up—it’s choosing a path that aligns with your goals