The Indian government like any other government needs huge financial resources to meet its mammoth annual expenditure. The chief sources of government revenues are obviously the taxes that we pay. There are broadly two types of taxes–direct and indirect taxes. Direct taxes constitute the income tax which citizens earning annual income beyond the minimum slab are bound to pay. Indirect taxes of on the other hand are sales taxes, excise, custom duties etc.

Filing taxes can be a complicated procedure especially if the assessee’s income levels are high generating from multiple sources. The government provides different types of exemptions and reliefs which keep on changing from financial year to year. The issue of taxation of business and commercial units is far more complex. Therefore to deal with issues related to tax compliance you need the services of a professional tax consultant.

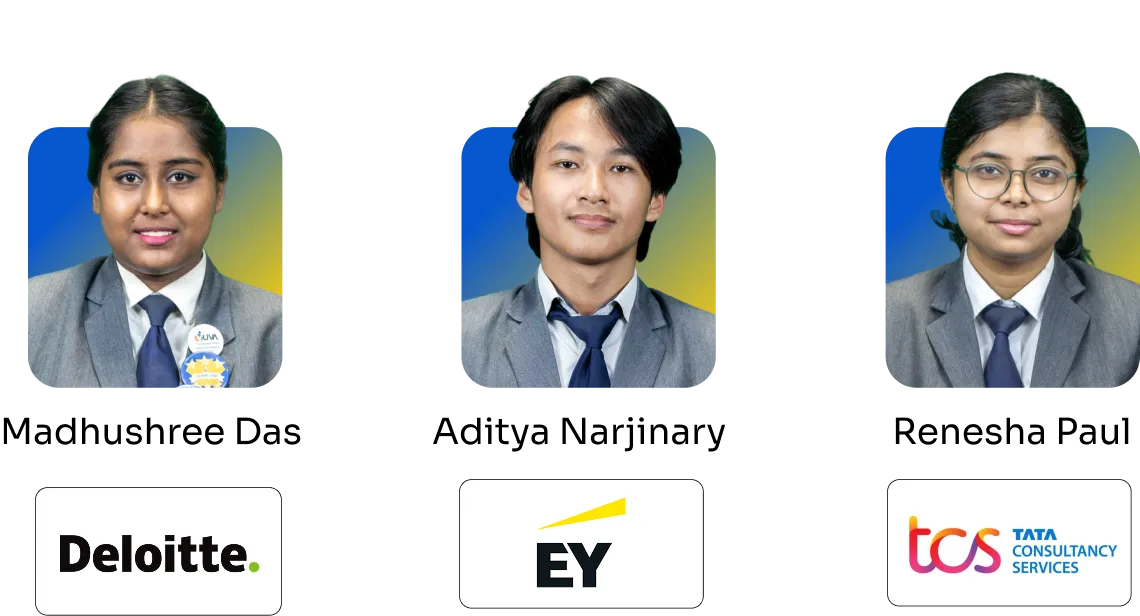

The career of a tax consultant is quite a lucrative one. Indeed good tax consultants working in big cities earn significantly more than a top corporate executive. A tax consultant often has a LLB degree as he has to contest tax related litigation in tax tribunals.

What is the degree required for a tax consultant? Decades back a commerce graduate preferably with a law background would learn the trade as an assistant to a tax lawyer and there were no formal courses in taxation.

Nowadays you have universities like Netaji Subhas Open University and Brainware in West Bengal which offer diploma in taxation. The University of Madras also offers a one year diploma in taxation course. The subjects include Tax laws, Income Tax, Communication Skills, Auditing and Financial Accounting. This is a post graduation diploma and the eligibility is a graduate degree in commerce or law. Some universities allow even arts and science graduates to take the course.

Members of the Institute of Chartered Accountants of India (called Chartered Accountants) and Members of the Institute of Cost Accountants of India (called Cost Accountants) have the qualification and knowledge to practice taxation law at a higher corporate level.

Also Read: Why You Should Study Taxation Course in 2020

The career of a tax consultant is challenging and rewarding as well. A successful tax consultant has to constantly update himself with government rules acts and rules pertaining to taxation, He gets the opportunity to meet different types of people from different backgrounds. The income he earns is also significant and far better than that from a salaried job.

One Response

I like this website because so much useful stuff on here.